3 Reasons 3PL Data Isn’t Good Enough

By TransVoyant Team

Despite a variety of visibility options on arrival and delivery times available from shippers, many supply chain managers tell us that that’s good enough to meet their needs. When we unpack the reasons, a clear pattern emerges.

These are the top three reasons that managers say shipper visibility isn’t sufficient:

3PL Data Isn’t Actionable

Early adopters were excited about visibility solutions, until they realized that a blinking dot on a map without any additional context has limited value. Sensors and other tracking methods may provide helpful data on where a shipment is right now, but that’s not enough information to inform action.

For example, a sensor indicates that a refrigerated shipment is still sitting on a dock in Savannah two days after it was supposed to have been loaded on a truck bound for Nashville. Managers have no idea why the shipment was delayed, what condition it is in, or where the Nashville-bound truck is. Without that context, nobody can make meaningful decisions.

3PL Data Isn’t Complete

Visibility needs to be considered in two dimensions – depth and breadth. Depth is how granular the insight is (e.g. product, SKU, part, cost). Breadth is how much of the supply chain can be seen (all modes, nodes, and geographies across the entire supply chain).

Most visibility journeys start small by focusing on a single segment of the supply chain. Unfortunately, this siloed approach doesn’t create visibility to events occurring upstream and downstream in the value chain. This is problematic for operations that rely on inbound materials to produce finished goods to be shipped around the world to customers.

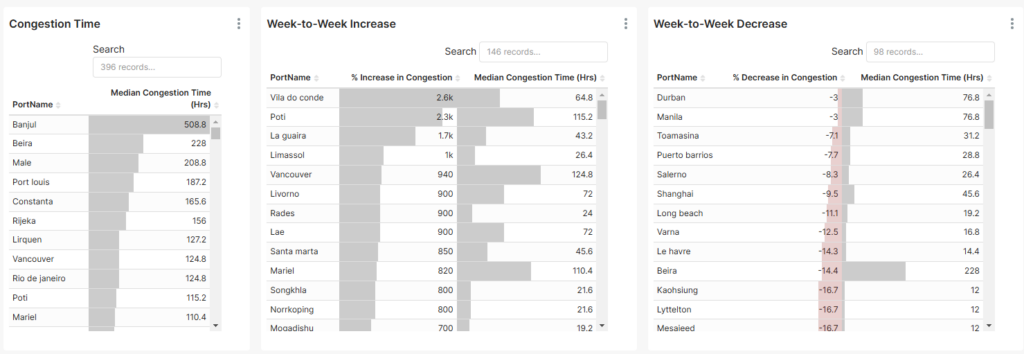

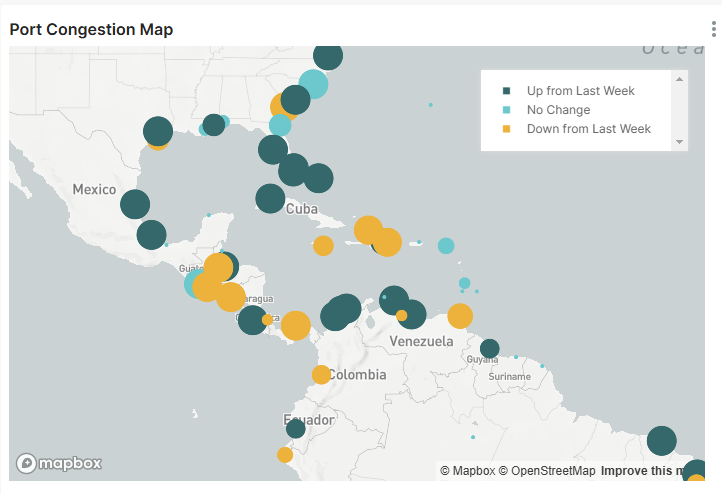

Full visibility needs to incorporate information from inside an enterprise (e.g. ERP, TMS, WMS) and the external world that surrounds the supply chain (e.g. social unrest, border crossings, port congestion, etc.). Without this level of connectedness, managers will have blind spots in the supply chain that will inevitably cost time, service, and money.

3PL Data Isn’t “Intelligent”

Anyone who has tried to operationalize the data they receive from their logistics service providers understands the inconsistency in quality, timeliness, format, and metrics they receive. Inconsistent data is difficult to automate, and the risk of errors is very high.

By contrast, “intelligent” data shapes itself into the format required and integrates easily with existing platforms. It adapts to changing requirements and can incorporate new data sources.

Even if we assume that the data has been tamed, managers must mine the deluge of data to find the nuggets of important insight that impact day-to-day operations and strategy. This is not an easy challenge if you are managing hundreds or thousands of shipments daily. In fact, it’s impossible to do manually, but intelligent data flows can be automated so that alerts are appropriately prioritized and forwarded.

Many organizations underestimate the amount of time, tools, and effort required to effectively deploy and manage supply chain logistics. That’s why the most innovative companies are turning to the provider market for solutions and services to ensure complete visibility and actionable insights.